Credit that lifts you

Flexible loans to pay off credit card debt and consolidate balances

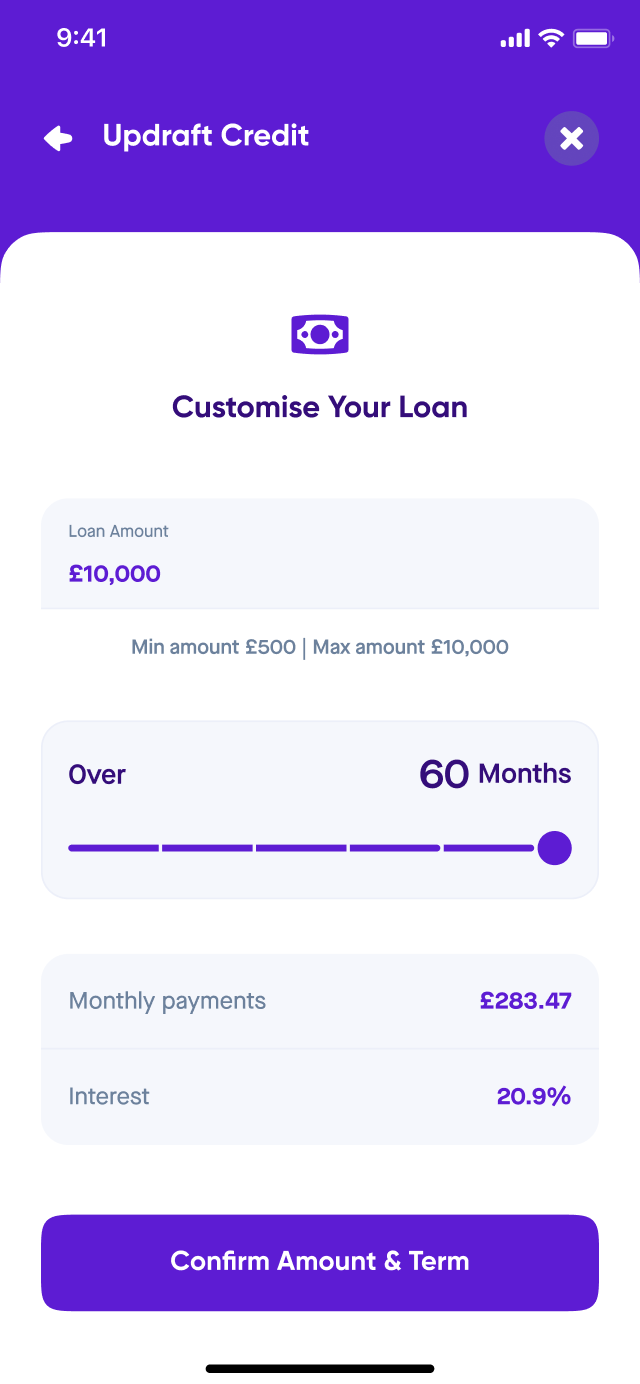

Representative Example

24.6% APR Representative based on a £10,000 loan over 60 months at 19.9% fixed interest p.a. Monthly repayment: £277.60. Total repayable: £16,656 (inc. £500 fee). Subject to status and affordability. Consolidating debt may increase the term and total amount repaid.

All figures are representative and based upon an assessment of credit and affordability. Terms and conditions apply.

From held back to lifted up

See how UK customers use Updraft’s debt consolidation loans to clear credit card debt.

Nikki Batchelor

Very straightforward and easy to…

Very straightforward and easy to complete fantastic service

December 30, 2025

Suzanne Marie Teofilo

Quick and easy

Easy to apply, quick decision and fast in sending money

December 30, 2025

Stuart Gibson

Great service

Great service. Comms went quiet for a while hence the 4 not 5 star. Really clear and really helpful.

December 30, 2025

kamran

The process is smooth and swift

The process is smooth and swift

December 30, 2025

Lorna Brown

Good company to deal with

Very easy to apply but then very exact in affordability & your current circumstances. Felt they investigated to make sure you weren't getting into a worse situation than you were. Very friendly ...

December 30, 2025

mr c j nuttall

Comprehensive application which is…

Comprehensive application which is pleasing that the company did in depth checks

December 29, 2025

Lloyd mullen-cooper

Quick and easy

Quick and easy

December 29, 2025

Gavin Williams

Very quick

Very quick, very easy and has solved my issues completely

December 28, 2025

Anna Zannides

A smooth and easy process from start to…

A smooth and easy process from start to finish! Highly recommend.

December 27, 2025

ALISON

Definitely recommend

Definitely recommend! Really easy process and quick pay out!

December 27, 2025

Keith Woods

Efficient and very simple

Efficient and very simple

December 27, 2025

Ken

Fast

Fast, effective, professional!

December 26, 2025

Mr Richard Lawrence

Awesome and easy

Awesome and easy

December 26, 2025

Tiago Cruz

Amazing stress free company

Amazing stress free company

December 24, 2025

Tom Humphries

The process was easy

The process was easy. The things I like most is the little bits of advice in regards to paying off certain debts first. These little things will help you reduce your monthly outgoings in the best w...

December 24, 2025

Ross

Excellent Service

Excellent service, simple to understand, great infromation presented

December 24, 2025

John Mavazhe

fast in approving and processing

fast in approving and processing

December 23, 2025

Stefan

Great service very prompt and efficient…

Great service very prompt and efficient thank you

December 23, 2025

Rated 4.8 stars

Rated 4.8 stars

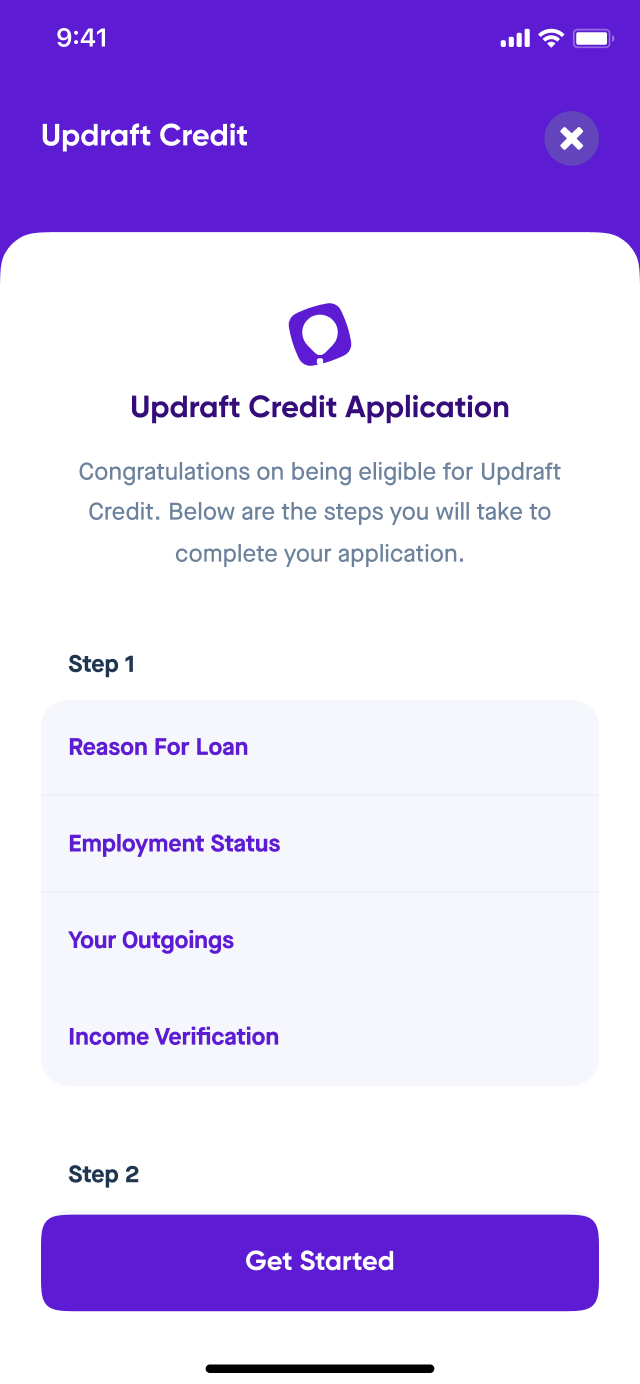

How Updraft works

Debt consolidation as simple as 1-2-3

Step 1

Enter a few details about yourself, your earnings and outgoings

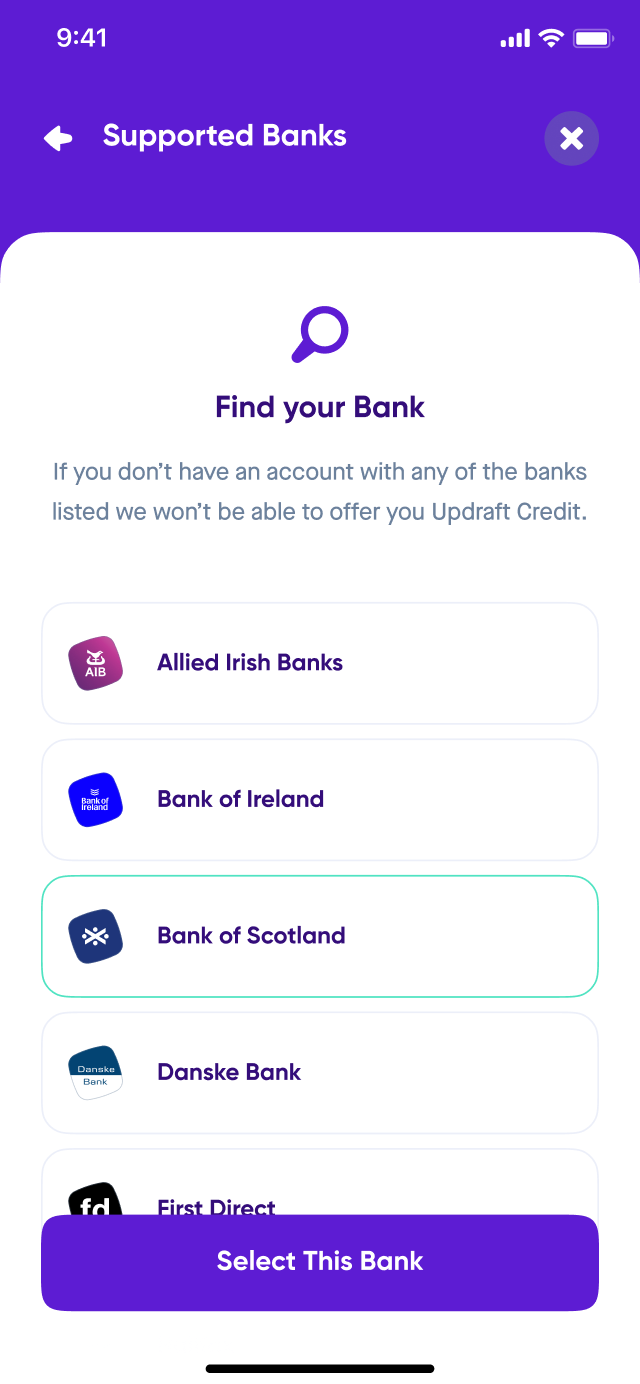

Step 2

Connect your bank to Updraft so we can verify your identity and income

Step 3

If approved, customise your loan and we’ll send you the funds

Why Updraft?

Safe, secure, & regulated

Powered by Open Banking.

Securely view all your bank accounts and credit cards in one place — and spot what’s costing you most.

Falling Into Debt One Tap at a Time – Updraft TV Advert

Net vs Gross Income: Understanding Your Payslip

What’s the Average Credit Score in the UK?

Frequently Asked Questions

Thinking about a loan to pay off credit card debt? These quick answers explain how Updraft’s debt consolidation loans work and what to expect before you apply.

What is a credit card debt consolidation loan?

A credit card debt consolidation loan lets you combine multiple credit card balances into one loan. This can make your borrowing easier to manage with a single monthly repayment. It’s a common debt solution in the UK for people wanting to simplify their finances.

How does a loan to pay off credit card debt work?

You can use a personal loan to pay off your credit cards, then repay that loan in fixed instalments over time. Updraft offers flexible credit options that help you consolidate credit card debt safely and stay on top of your repayments.

Will consolidating my credit card debt affect my credit score?

Applying for a debt consolidation loan may cause a short-term dip in your credit score, but making regular payments on time can help build a stronger profile over time. Updraft checks your eligibility with no impact on your credit score.

What are the benefits of consolidating credit card debt?

Consolidating credit cards can simplify your borrowing with one payment and potentially lower interest compared to multiple cards. It’s not about borrowing more - it’s about clearing your credit card balance in a structured, manageable way.

Am I eligible for a credit card debt consolidation loan with Updraft?

To apply, you’ll need to be a UK resident aged 18+, have a regular income, and hold a UK bank account. Eligibility depends on your credit history and affordability. Checking your rate with Updraft has no impact on your credit score.

By proceeding with checking eligibility, you are agreeing to receive documentation (including any loan documentation) digitally through the Updraft app and to your email address.

You also acknowledge, should you accept a loan offer, you will only be able to manage this via the Updraft app.