Tired of debt that just won’t stay gone?

Like a yo-yo, you pay it down and somehow, it springs right back. Interest, fees, and never-ending minimum payments keep you stuck in the same frustrating cycle. At Updraft, we help you cut the string and stop the spin for good.

With one affordable loan, you can pay off your cards once and for all and lift your credit score too.

No more juggling balances. No more backwards steps. Just a clear, simple way to move forward and stay there. Checking your rate takes minutes and won’t affect your credit score.

By consolidating existing borrowing, you may extend the term of your debt and increase the total amount you repay. Failure to make payments on time means you will pay additional interest and may make obtaining credit in the future more expensive and difficult.

Try our Pay Off Calculator & see what you could save

Credit Card Balance

Credit Card APR (%)

How much do you pay monthly?

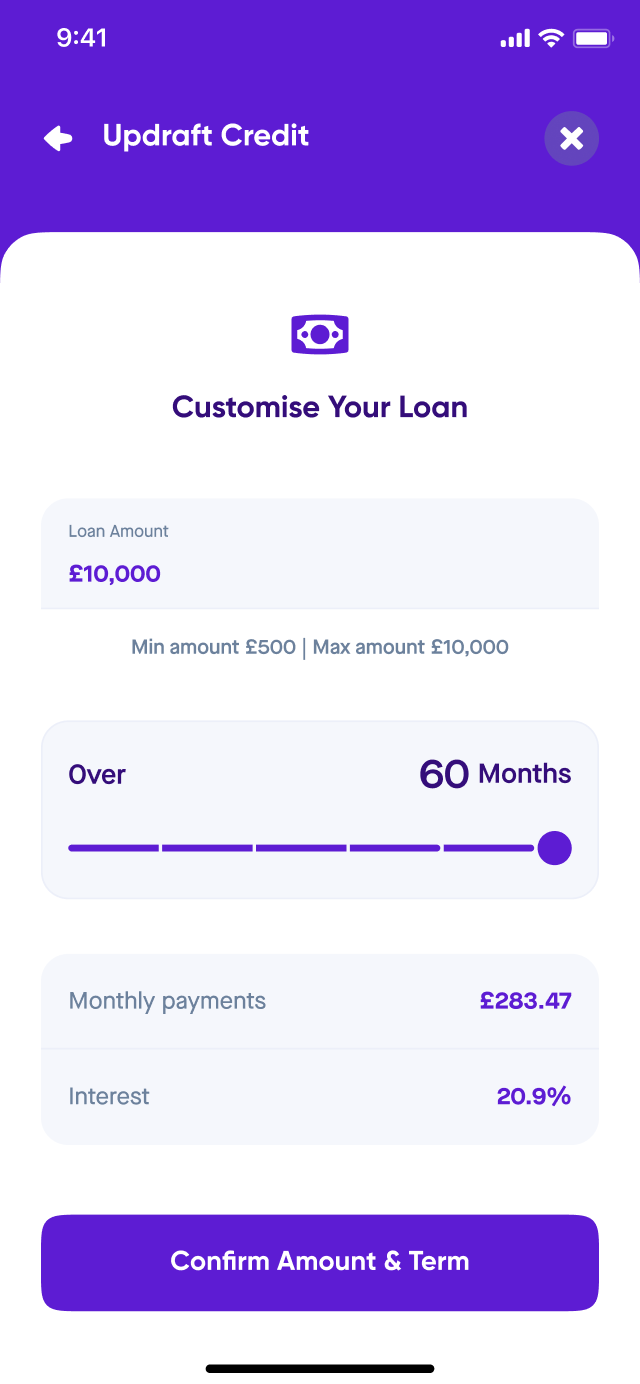

26.5% APR representative based on a loan amount of £10,000 over 60 months at a fixed interest rate of 21.9% p.a. This would give a monthly repayment cost of £286.65 per month, with a total cost of credit of £7,198.74 (includes loan fee of £400) and a total amount repayable of £17,198.74.

From held back to lifted up

See how our users rise above debt & get better credit

Tracey Grzesica

Very professional service and friendly…

Very professional service and friendly staff

July 16, 2025

Mrs Wood

Loan

Updraft is easy to use online decision about the loan didnt take long they are quick to get back to you

July 15, 2025

Giuseppe Marguccio

Fastest than you think

Very easy and straightforward process as fast as a blink of eye

July 15, 2025

Bolts

Thank you for helping me get all the…

Thank you for helping me get all the debt into one manageable monthly payment , super quick service and can not recommend enough !

July 14, 2025

Farhaan Mohideen

Thank you for a the no fuss approach

Thank you for a the no fuss approach So quick to make the decision and offer the loan. I chose this to just pay off my credit card and there are no over payment charges- just fantastic

July 14, 2025

Joanne Budd

Process of applying is easy to follow

Process of applying is easy to follow. Clear information and relatively quick.

July 12, 2025

Claire

Very good

Great, super fast service - thanks

July 11, 2025

Amanda Long

Easy and stress-free experience

Updraft made the experience so easy and stress free. Everything was explained clearly and the results were quick. The app is also a great addition and I love the fact you can keep track of the loa...

July 11, 2025

Louisa

Easy application …

Very easy to apply with step by step information.

July 11, 2025

Tracey Grzesica

staff very helpful and professional.

staff very helpful and professional.

July 10, 2025

Robert

Was a very easy service to use and kept…

Was a very easy service to use and kept you updated regularly

July 9, 2025

Blake

Great people

Great people

July 9, 2025

Marie Shaw

Excellent experience

Great response times easy to apply

July 9, 2025

Daniela

Simple easy and affordable lending

Simple easy and affordable lending, the whole process from application to pay out was super straight forward and felt informed and supported. It was my lifesaver to pay off some debts and have a mo...

July 8, 2025

Keith Sumner

Fast reliable on absolutely amazing

This company is amazing. There fast efficient and always have your best interest that heart cannot fault them. This is the second time they’ve helped me out thankyou

July 8, 2025

Sue McKerlie

So simple and a great experience

So simple and a great experience

July 7, 2025

Alison Bullous

Great service

Great service, hassle free would highly recommend.

July 7, 2025

gary law

great company

such a great easy process from start to finish great communication highly recommend this company

July 6, 2025

Debra Martin

Absolutely fantastic company

Absolutely fantastic company. Its easy to apply. I feel releaved that a company like updraft are around to help people. 100% trustworthy.

July 6, 2025

Joanne

Everything was done and set quickly

Everything was done and set up quickly. I had money in my account the next. Would really recommend 👌

July 5, 2025

Rated 4.8 stars

Rated 4.8 stars

Here’s what you’ll need to apply

You’ll need to be at least 18 years old with a history of using credit.

You’ll need to receive an annual income of at least £10,000 from employment or a pension.

Should you accept a loan offer, you will need a supported mobile device to download our app and manage your loan. Your mobile device must be running iOS 16 or later, or Android version 7.0 or later.

By proceeding with checking eligibility, you are agreeing to receive documentation (including any loan documentation) digitally through the Updraft app and to your email address.

You also acknowledge, should you accept a loan offer, you will only be able to manage this via the Updraft app.

About Updraft

Helping you get credit and build financial freedom.

At Updraft, we believe managing your money – and clearing debt – should feel safe, transparent and positive. We’re committed to doing things differently in this space.

Here’s what you can expect from us:

Award-winning: A trusted credit and bill consolidation lender.

FCA regulated: Authorised and regulated by the FCA (refs 810923).

Simple: Apply online in minutes — no paperwork, no hassle.

Empowering: Track your credit score and debt repayments in one app.

Popular: Almost 1 million installs across App Store & Google Play.

Trusted: Thousands of UK customers rate us Excellent on Trustpilot.

Supportive: Built to help you clear debt and take control of your finances.

Frequently Asked Questions

Checking your eligibility won’t affect your credit score, so it’s risk-free to see if Updraft is right for you.

Is Updraft regulated?

Yes - Updraft is a trading name of Fairscore Ltd. We’re authorised and regulated by the Financial Conduct Authority.

Will checking my rate affect my credit score?

No - checking your rate is quick and won't affect your credit score. If you decide to go ahead and apply, we’ll run a full credit check at that point.

How much can I borrow?

Loan amounts depend on your credit and affordability, but we typically lend between £1,500 and £20,000.

What’s the interest rate?

Your rate will depend on your personal circumstances, and you’ll see your exact offer before deciding to go ahead. Our representative APR is 26.5%.

Can I repay my loan early?

Yes - you can repay your loan early at any time, and we won’t charge any fees for doing so.

Will consolidating my debts affect my credit score?

It can - in a good way. Paying off high-interest credit cards with a single affordable loan can improve your credit score over time, as long as you keep up with repayments.

What happens if my circumstances change?

We know life doesn’t always go to plan. If things change and you’re struggling to make payments, get in touch with our support team. We’ll work with you to find a solution that helps.

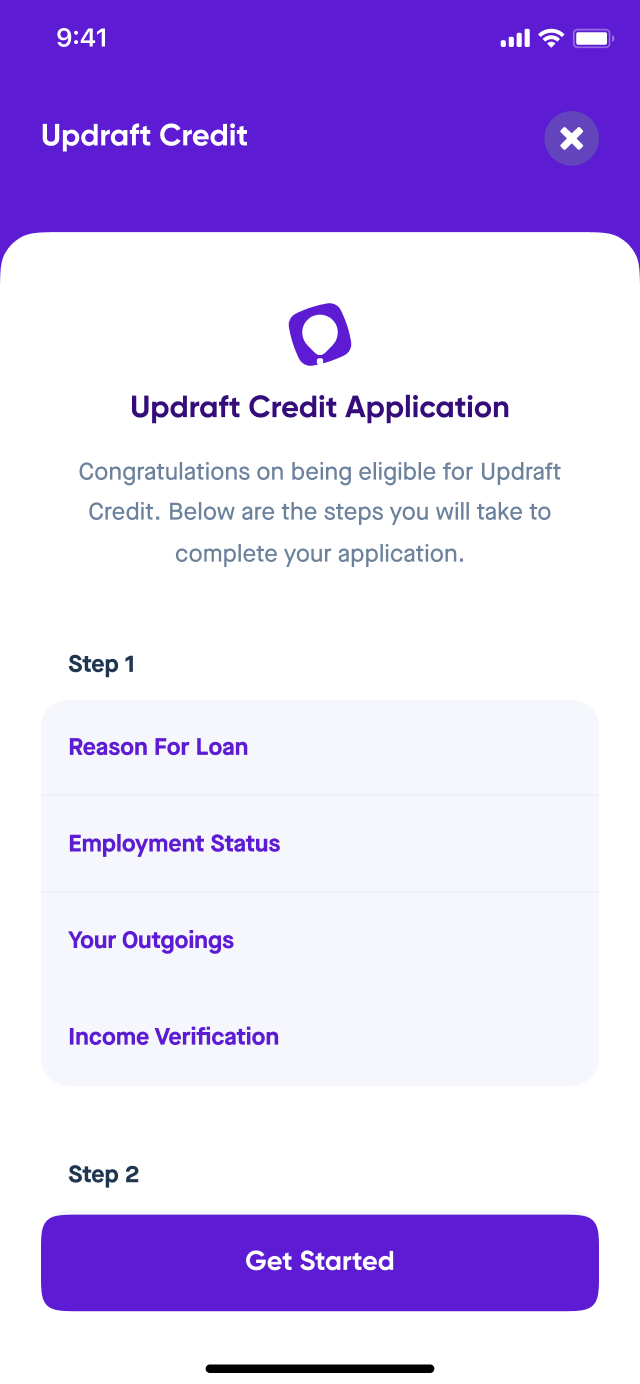

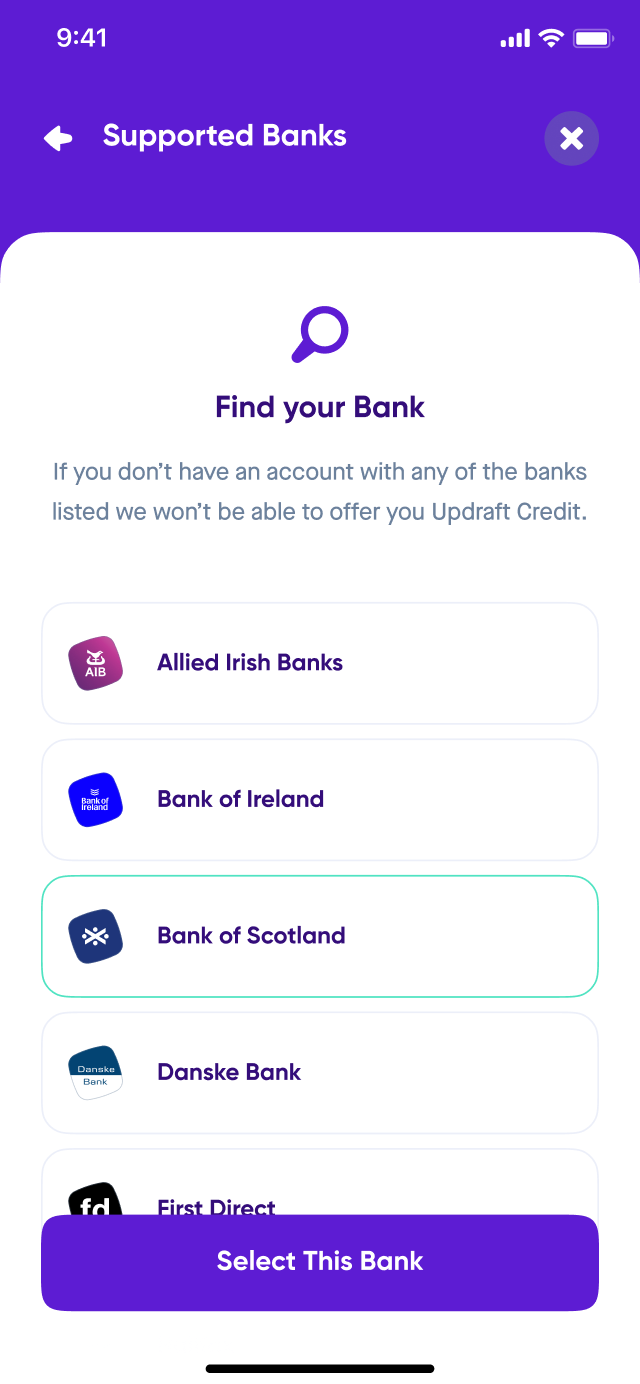

How Updraft works

Simple as 1-2-3

Step 1

Enter a few details about yourself, your earnings and outgoings

Step 2

Connect your bank to Updraft so we can verify your identity and income

Step 3

If approved, customise your loan and we’ll send you the funds