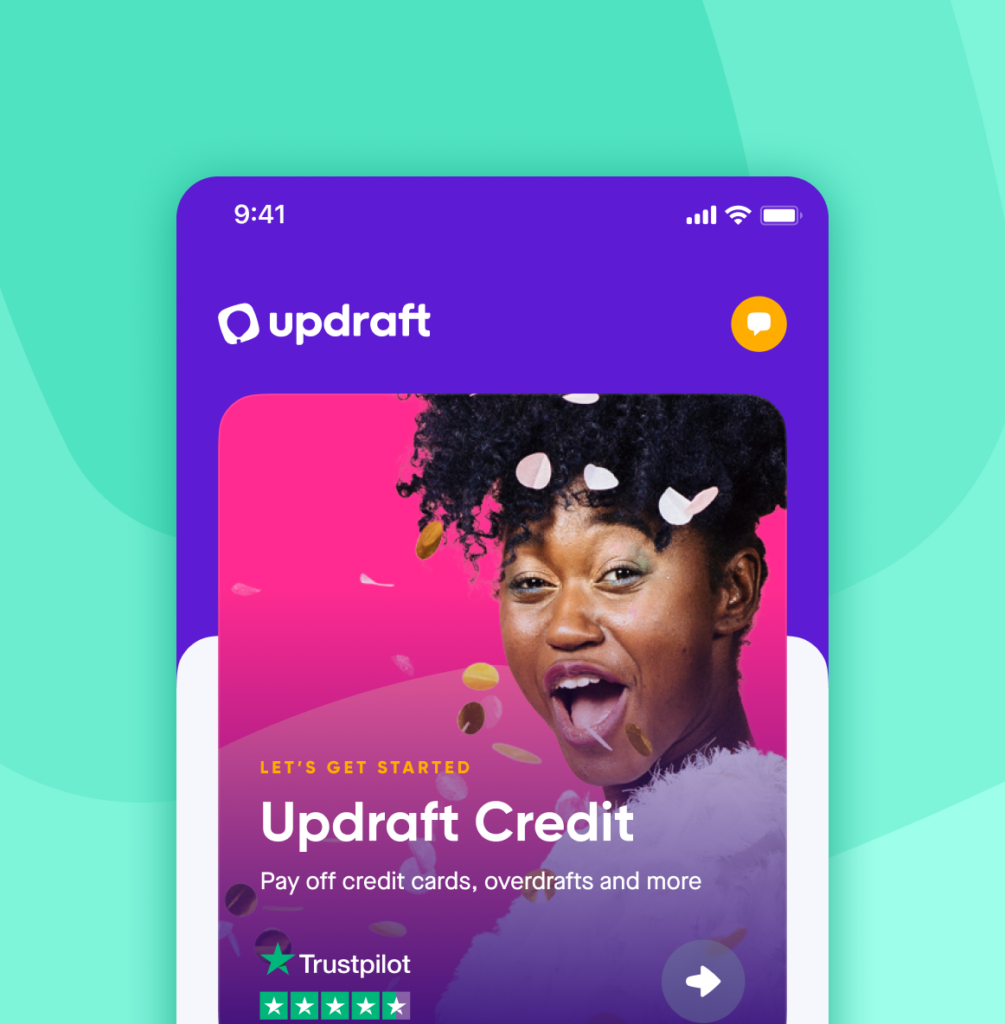

A loan to pay off credit cards

Tired of credit card chaos? One loan, one payment, less stress.

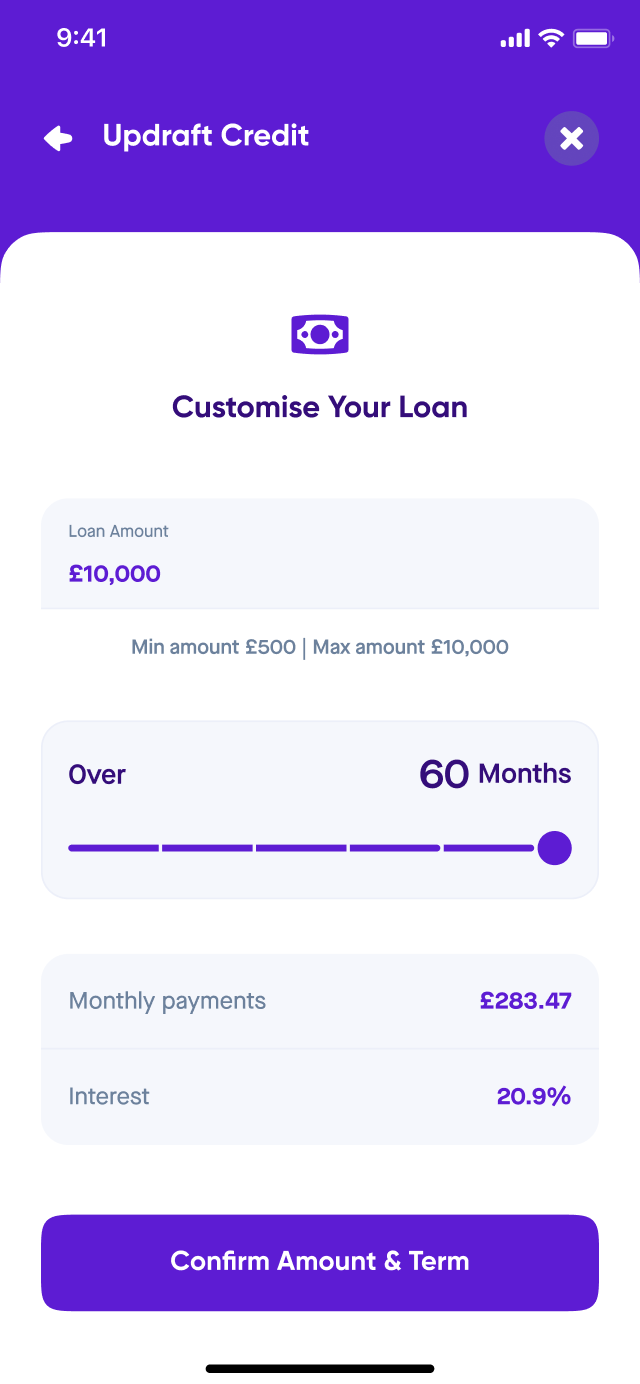

Representative Example

26.5% APR representative based on a loan amount of £10,000 over 60 months at a fixed interest rate of 21.9% p.a. This would give a monthly repayment cost of £286.65 per month, with a total cost of credit of £7,198.74 (includes loan fee of £400) and a total amount repayable of £17,198.74.

All figures are representative and based upon an assessment of credit and affordability. Terms and conditions apply.

From held back to lifted up

See how our users rise above debt & get better credit

Peter McNicol

Great from start to finish

Great from start to finish, really helped me through all the steps and made it so easy to complete

June 27, 2025

ʟᴀᴅᴀ s.

quick and easy

The process took a total of like four days from start to finish and it was super simple. Got myself into a small financial hole that i couldn’t get out of and now it’s like a weight been lifted of ...

June 26, 2025

Cheryl Craswell

Just easy to deal with

Just easy to deal with

June 26, 2025

Polly

I was looking for a consolidation loan

I was looking for a consolidation loan. On general comparison websites I was quoted for 30% APR which hurt. I applied to this and was given 15% APR- AMAZING! Funds were in my bank the next day. All...

June 26, 2025

jane

I don’t usually write reviews

I don’t usually write reviews, but I felt I had to share my experience with Updraft. I was feeling really overwhelmed with my finances and needed something to help me get back on track fast. I came...

June 26, 2025

Martin Cotes

They were diligent in there checks

They were diligent in there checks with me but fair and the offered what I needed. Funds should clear in the next 2-5 days. It really helps me breath financially! Thanks updraft for supporting me ...

June 25, 2025

Oh no you don't None

Fantastic service from start to finish…

Fantastic service from start to finish , great customer care, very easy to use , would highly recommend

June 24, 2025

Jasmine Hunt

The updraft team were extremely helpful…

The updraft team were extremely helpful and tailored a loan that would suit me best, communication from Updraft was 10/10 and the loan is at an affordable rate. Thankyou team Updraft, Simon & Ashle...

June 24, 2025

Carmena Anduque

Quick and easy.

Quick and easy.

June 24, 2025

Kyran Eakins

Incredible service

Incredible service. Super reasonable interest rates. Amazing ease in securing a loan. Very transparent. Not a bad word to say in all honesty. I’m willing to absolutely use again and recommend to fr...

June 24, 2025

Denise Day

Excellent customer service

Used Updraft a few times and not only did the money come through within 24 hours, they were also very patient unmuddling the mess I'd made of recent payments

June 23, 2025

Philip Griessel

Brilliant

Brilliant, quick, no nonsense, all online

June 23, 2025

Lucy Williams

Highly recommend this lender

The whole process was so straightforward and simple from beginning to end. Managed to secure the funding I required within a few days I would highly recommend updraft if you are seeking, fast, h...

June 23, 2025

Jaleel

Process was easy and straightforward

Process was easy and straightforward. Whilst speak with staff they were helpful and polite throughout

June 22, 2025

Leszek

I waited 2 days for confirmation that's…

I waited 2 days for confirmation that's why just 4 stars but good service thanks

June 21, 2025

Caroline Wharton

Quick and Friendly

The whole process was very quick and efficient. Customer service was excellent.

June 21, 2025

Stefan Atter

Quick loan

Used them for a previous loan - quick & easy to apply

June 21, 2025

Alison

Easy process

The whole process was simple to understand and very fast. Support was good and was great to be able to personalise the loan to suit me.

June 21, 2025

Andresa Cardoso

Fantastic customer service and life…

Fantastic customer service and life changing!!

June 20, 2025

Stephen Ibbitt

Very fast and straight forward…

Very fast and straight forward information

June 20, 2025

Rated 4.8 stars

Rated 4.8 stars

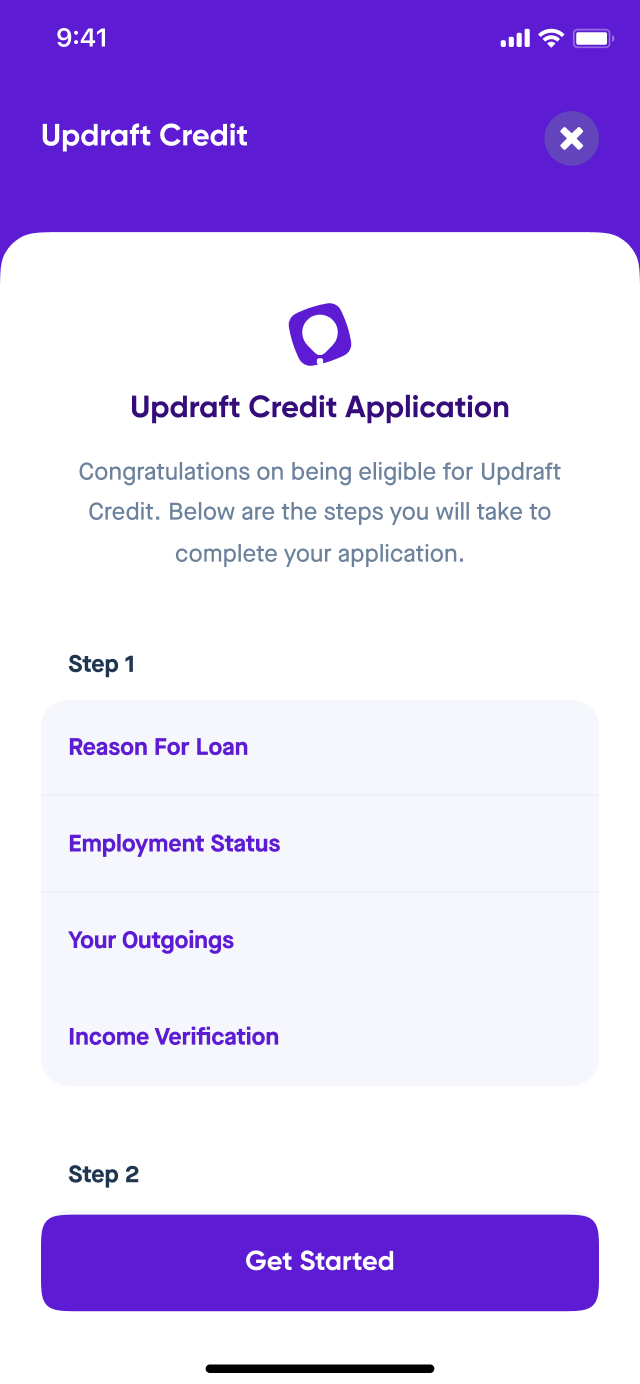

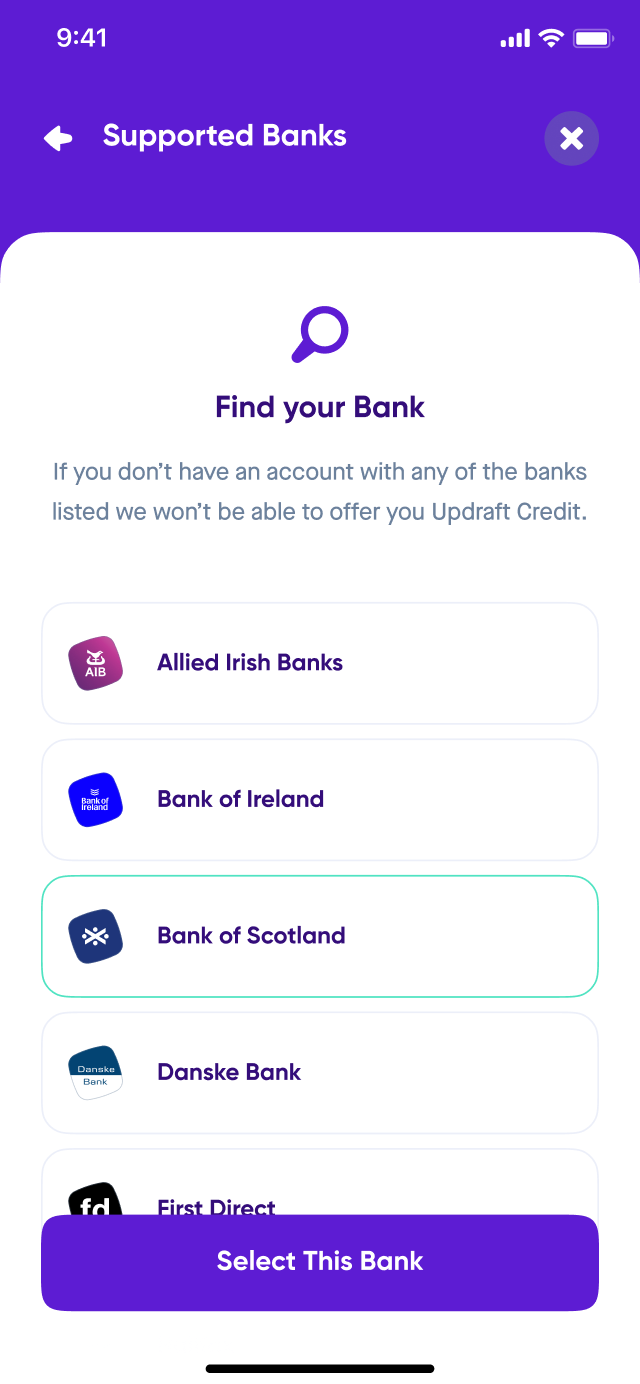

How Updraft works

Simple as 1-2-3

Step 1

Enter a few details about yourself, your earnings and outgoings

Step 2

Connect your bank to Updraft so we can verify your identity and income

Step 3

If approved, customise your loan and we’ll send you the funds

Why Updraft?

Safe, secure, & regulated

Powered by Open Banking.

Securely view all your bank accounts and credit cards in one place — and spot what’s costing you most.