Updraft News

News & Insights

Welcome to the official hub for Updraft company updates. Here is where we share the latest developments from inside our business, including press releases, product announcements, and industry recognition. Whether it is a new feature launch or insight into the lending market, you will find it here.

Try our Pay Off Calculator & see what you could save

Credit Card Balance

Credit Card APR (%)

How much do you pay monthly?

24.6% APR Representative based on a £10,000 loan over 60 months at 19.9% fixed interest p.a. Monthly repayment: £277.60. Total repayable: £16,656 (inc. £500 fee). Subject to status and affordability. Consolidating debt may increase the term and total amount repaid.

Frequently Asked Questions

What is Updraft?

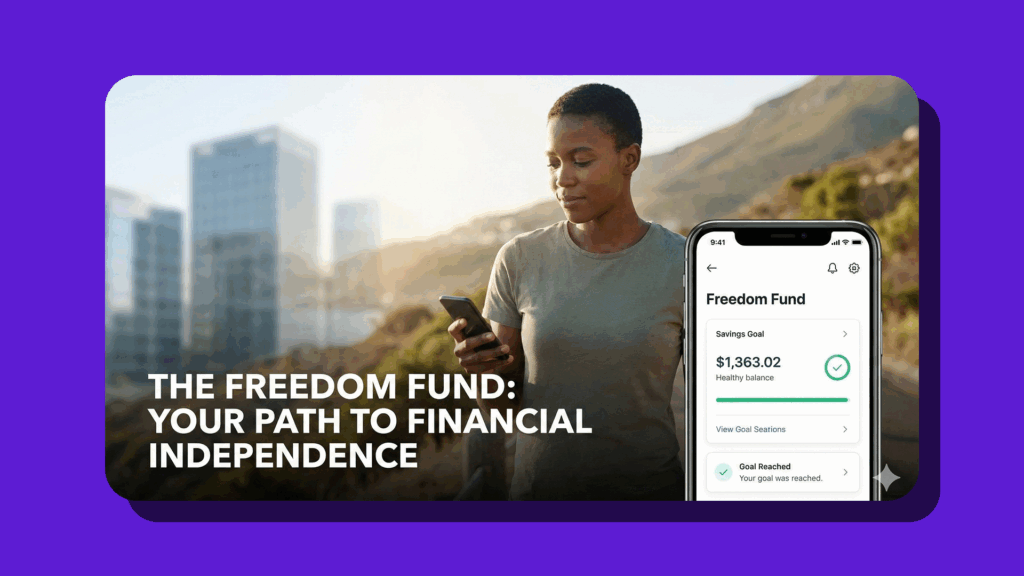

Updraft is a financial app on a mission to help people clear debt and build financial freedom.

We use Open Banking technology and smart algorithms to build a 360-degree picture of your finances. Unlike traditional lenders, we don’t just offer loans; we provide a clear path to pay off high-interest credit cards and overdrafts faster, helping you move forward with confidence.

Who is Updraft designed for?

Updraft is built for “multi-card jugglers”-people who are managing credit but want a smarter, lower-cost way to pay it off.

We support people who are ready to consolidate their borrowing and build a better financial future. By refinancing expensive debt into a single, lower-cost payment, we help our members save money on interest and become debt-free sooner.

How is Updraft different from a bank?

We are a Challenger brand, meaning we are here to reset expectations in the financial category.

While traditional finance brands often profit when customers stay in debt, our entire business is built on getting you debt-free. We replace “scary” financial jargon with safe, supportive tools that empower you to take control of your money.

Take control of your borrowing costs today

High interest can quietly drain your money — but it doesn’t have to. With the Updraft app, you can see the real rates you’re paying, cut back on unnecessary interest payments, and explore smarter ways to manage your money.

With a single payment and a clear loan term, you could clear your debt sooner. And with no settlement fees, you have the flexibility to pay it off early if you choose.

By consolidating existing borrowing, you may extend the term of your debt and increase the total amount you repay. Failure to make payments on time means you will pay additional interest and may make obtaining credit in the future more expensive and difficult.