We’re helping Brits take control of their credit card debt this summer

Updraft hired the UK's first Financial Lifeguard to help overspending Brits from going in too deep

We’re helping Brits stay afloat and in control of their credit card debt this summer

You know the feeling. The sun comes out, and suddenly you’re in four group chats planning weekends away, weddings, BBQs, bottomless brunches and last-minute “bargain” holidays. It’s joyful but financially, it can be chaotic.

That’s where we come in. At Updraft, we’re here to stop summer from pushing you into unmanageable credit debt. We’ve taken a deep dive into the data to uncover how summer impacts our spending (and spoiler: we’re all in too deep). That’s why we’ve enlisted the help of the UK’s first Financial Lifeguards, and created a budget buoy, to help keep you afloat.

While summer is all about fun, it’s also the season when credit card debt quietly spikes. And often, we don’t realise how deep we are until it’s too late.

Our Financial Lifeguards are making a splash in Manchester

We hit the streets with Faizan Shah, who we recruited as Manchester’s very own Financial Lifeguard, to see what’s really pushing shoppers into the financial deep end.

Dressed in full lifeguard gear, Faizan quizzed Brits on what’s sending them financially overboard this summer, offered encouraging tips, and even threw a few floats at people in danger of a budgeting wipeout. Why? Well, who said money talk has to be dry?

With the end of summer approaching, now’s the time to reflect on how much we’ve spent and why we spend the way we do when the sun comes out. It always helps to have someone in your corner, especially when you’re figuring out how to consolidate credit card debt and where to start.

Why is Summer sending us into credit debt?

To find out more on how summer is sending us in too deep, we surveyed 2,002 nationally-representative Brits and analysed five years of Updraft data on credit card loans to paint the picture on the extent of the phenomenon.

Based on five years of Updraft data, we found that credit card loan activity increases by £303 more in the summer months compared to the rest of the year. We typically see a spike just after the summer in September, likely due to unpaid balances catching up just as the fun winds down, and lenders often profiting when customers only make minimum repayments.

But it’s not just our customers: nationwide, the problem is growing. Based on our survey data, we estimate that this summer alone, the average person in the UK will add £1,641 to their credit card debt, up 21% from last year. So far, the 2,002 survey participants alone have already clocked up over £1.55 million in credit spending and if those balances aren’t paid off, interest could drive the average to £1,846 per person of credit card debt by Christmas.

While most people technically stayed within “safe” credit usage (under 25% of their credit limit), 6% have already crossed the danger line, going into over £3,000 in credit debt throughout summer.

We also saw generational and regional trends emerge, notably:

- 25–34-year-olds are the biggest summer spenders (over £2,100 on average by the end of this summer), despite being relatively early in their careers.

- South East England and cities like Bristol, London, and Leeds led in average summer spend, while Cardiff and Belfast spent far less.

That’s the big picture. But what’s actually driving it?

Weather, impulse & FOMO: The psychology of summer spending

We quizzed an additional 274 people who had sought loans for their credit card debt about their summer spending habits. The majority (58%) said summer itself was the reason for their overspending.

Nearly half (48%) were still paying off last summer’s purchases, and over 80% exceeded the 56-day grace period, meaning interest is already piling on.

So what’s behind these seasonal splurges? The top three influences that made people more compelled to spend are:

- Good weather: which 62% of people said made them want to “make the most of it.”

- Spending for enjoyment or an emotional boost: 36%

- Impulse purchases, triggered by the moment: 34%

Last year, fear of missing out (FOMO) was identified as a major driver of overspending 1, but what was really behind that feeling? Our recent research revealed the top triggers:

- Seeing people on holiday on Instagram/TikTok: 46%

- Group plans I couldn’t actually afford to join: 29%

- Friends at festivals or events: 12%

- Summer fashion or beauty trends: 8%

- Rooftop bars or beer gardens: 5%

From sunny-day sales to spontaneous trips and pub lunches that turn into all-dayers, the pattern was clear: good vibes come with a cost.

From holidays to hen dos: Why summer is leaving the UK caught up in credit card debt

Diving deeper, we asked these 274 people where their money is going this summer. The most common culprits? Holidays and weekends away, followed by day trips, eating out, transport costs, summer wardrobes and events. And while weddings, festivals, and hen dos didn’t top the list in volume, they took a toll on some individual’s budgets.

Even small splurges like new outfits, drinks in the sun, or spontaneous online purchases, add up when the weather tempts us outside more often. With 61% of people admitting they didn’t budget at all, it’s no wonder things spiral.

When asked how they felt after summer spending:

- One-third said they were motivated to fix their finances.

- 31% felt anxious.

- 21% felt regretful.

- Only 5.9% said it was “worth it for the fun.”

Psychologist shares why we all overspend in the heat

Summer creates what is known as the “temperature-premium effect”; when we’re physically warmer, we tend to perceive products and experiences as more valuable, meaning a sunny day can literally heat up our willingness to spend.

Psychologists agree: this is more than just poor planning, it’s human psychology.

We spoke to Dr. Pavlo Kanellakis, a Chartered member of the British Psychological Society, who gave us further insights on our findings:

“Summer could create what we call ‘seasonal optimism bias’ – people may feel more positive about the future, so they could be more willing to spend money they haven’t earned yet. It’s not a character flaw – research suggests it could be related to brain chemistry changes. Summer may make us think somewhat differently, in ways that could make us more optimistic, more social, and potentially more willing to take financial risks.

“We observe this pattern across many wealth levels, though the scale may vary. Families will make major financial decisions during beautiful summer days that they would never make in January. Whether it’s a family stretching their budget for a summer vacation or a wealthy family making major acquisition decisions during beautiful weather, the underlying psychology could be similar – good weather may create optimism that can override careful financial planning.”

Float, don’t flail! Updraft’s top 10 ways to stay afloat

Whether it’s group holidays, expensive nights out, or just keeping up with the vibe, we often choose fun in the moment and pay for it long after.

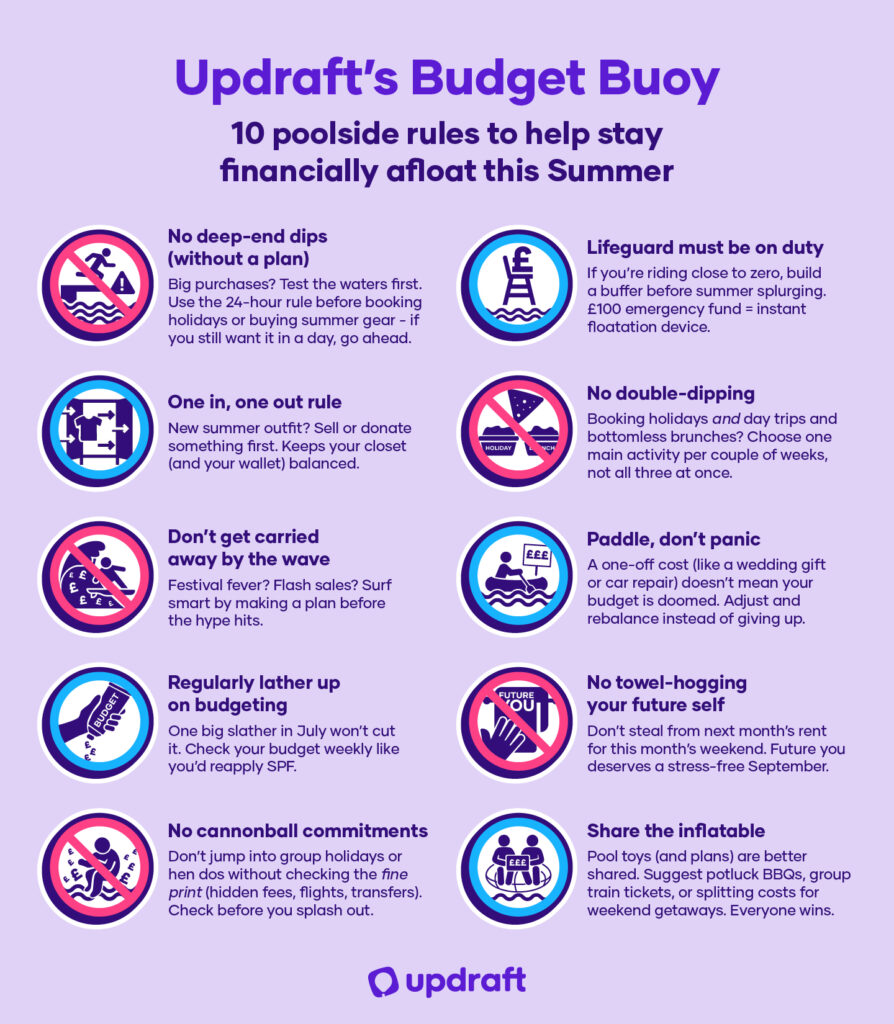

That’s why we created the Updraft Budget Buoy: a set of 10 poolside rules for navigating summer spending. From the 24-hour rule for big purchases, to our “No Towel-Hogging Your Future Self” philosophy, each tip is designed to keep you grounded when your budget starts drifting.

Methodology

This analysis combined internal data and consumer surveys to explore seasonal trends in credit card borrowing, particularly during the summer months.

Updraft’s internal data, covering five years of credit card loan activity, was analysed to identify monthly patterns and highlight spikes in summer borrowing.

To understand consumer behaviour behind these trends, two surveys were conducted in late July 2025. The first surveyed 274 individuals who had previously received a credit card loan, focusing on summer-specific spending habits and reasons for overspending. The second was a nationally representative survey of 2,002 UK adults, examining both current and past summer credit card debt. The national data reinforced the summer spending increase observed in Updraft’s internal figures.

Smart spending should be as easy to follow as pool safety signs. Whether it’s applying your budget like sunscreen (little and often) or learning when to say no to cannonball commitments, the Budget Buoy is your flotation device when financial pressure rises.

At Updraft, we’re here to help you reduce your reliance on high-interest credit and make better informed financial choices. That’s why we’ve made it our mission to give people tools, insights and support to stop living paycheck-to-paycheck or summer-to-summer, before you find yourself ‘in too deep’.

Final Thought

Want to take control of your money? If you’re looking to consolidate credit card debt and cut down on high interest, download the Updraft app today.

Loans from 14% APR. 24.6% APR Representative.

24.6% APR Representative based on a £10,000 loan over 60 months at 19.9% fixed interest p.a. Monthly repayment: £277.60. Total repayable: £16,656 (inc. £500 fee). Subject to status and affordability. Consolidating debt may increase the term and total amount repaid.

All figures are representative, the rate you are offered will depend on an assessment of credit worthiness and affordability. Terms and conditions apply.