Money Talk

Expert guidance and resources to help you manage credit card debt.

Discover practical repayment strategies, budgeting tips, and support.

- All Posts

- Clearing Card Debt

- Credit Scores

- Debt Consolidation

- Smart Money Habits

- Updraft Awards

- Updraft News

All Posts

- All Posts

- Clearing Card Debt

- Credit Scores

- Debt Consolidation

- Smart Money Habits

- Updraft Awards

- Updraft News

Monthly Budget Planner: Track Spending & Save

Taking control of your finances starts with one simple action: creating a budget. This guide provides a simple budget template UK families and individuals can ...

Read More

Soft vs Hard Credit Checks Explained

Not all credit checks are the same. This guide explains the differences between soft and hard credit searches, their impact on your score, and how ...

Read More

UK Credit Reference Agencies Explained

Discover the role of the UK's three main credit reference agencies. Learn how Experian, Equifax, and TransUnion track your financial history and how you can ...

Read More

Dopamine Tapping: The new feel-good fix that’s fueling problem spending

New Updraft research reveals that the average Brit spends £2,832 a year on "feel-good" purchases. We explore the rise of dopamine tapping, the "January replacement" ...

Read More

Falling Into Debt One Tap at a Time – Updraft TV Advert

Small taps of debt can add up before you realise it. Explore the message behind the Updraft TV advertisement and why micro-debts can quietly become ...

Read More

Net vs Gross Income: Understanding Your Payslip

Confused by your payslip? We explain the real difference between net vs gross income, how to calculate your take home pay, and what deductions like ...

Read More

What’s the Average Credit Score in the UK?

Understanding the UK credit score benchmark helps you gauge your financial health. We break down the average scores for Experian, Equifax, and TransUnion and explain ...

Read More

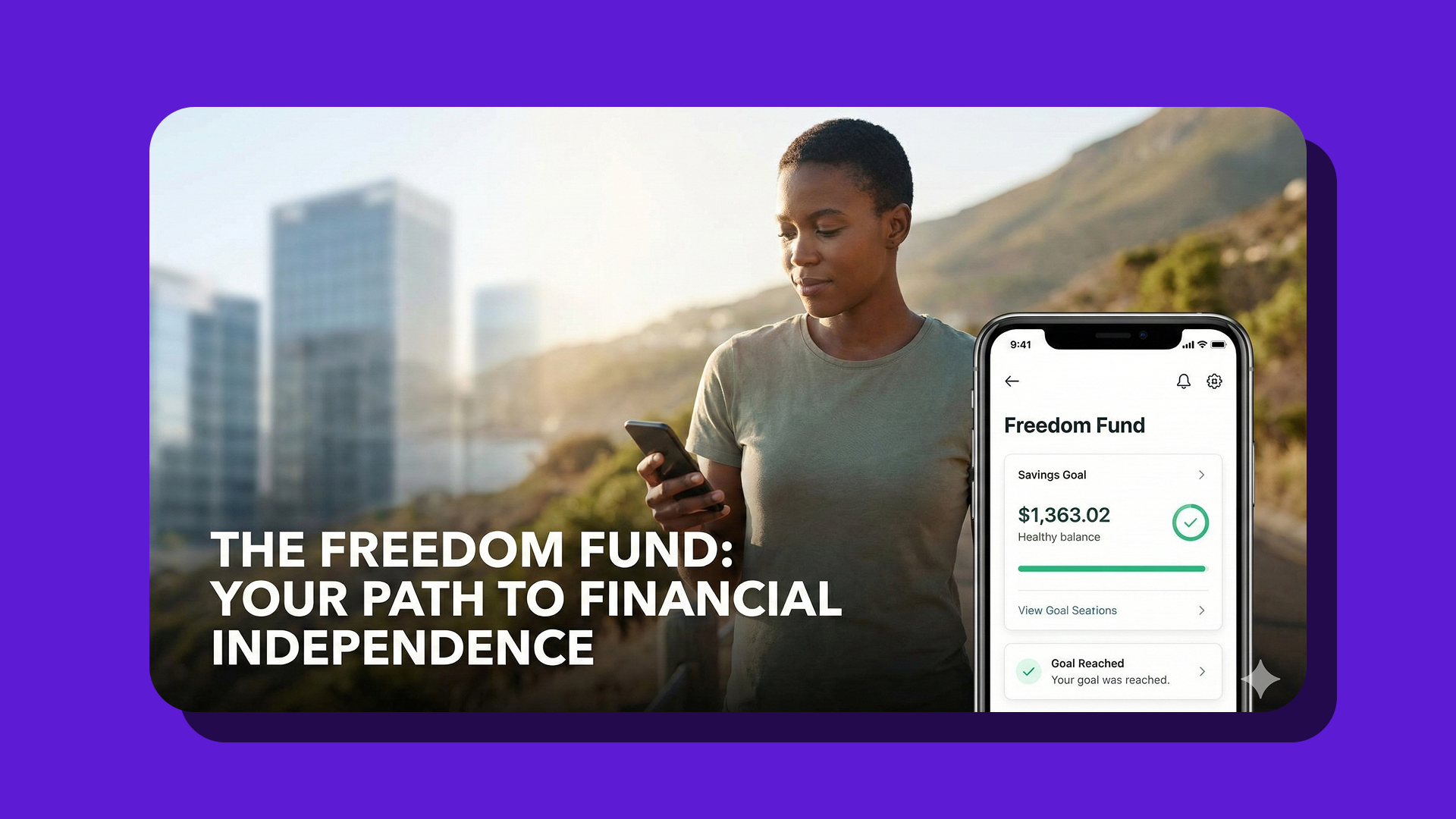

What is “F*** you money” and how can people build freedom funds as half of Brits live paycheque to paycheque?

The concept of "f*** you money" is trending on social media, with searches for financial freedom up 81%. We explore why this "freedom fund" idea ...

Read More

Christmas secret spending costs UK households over £413 – here’s how TikTok’s ‘Project Pan’ method can help you save

Christmas secret spending costs UK households over £413. We explore how TikTok’s Project Pan method can help you save by using up what you already ...

Read More

How to Budget for Christmas – Christmas Budget Calculator

Don't let festive spending ruin your January. Use our free Christmas Budget Calculator to set a sensible spending limit based on your salary, not just ...

Read More

Inflation holds steady at 3.8% but high food prices push 6.6 million Brits to rely on credit cards for essentials

UK inflation remains steady at 3.8%, but stubbornly high food prices are pushing 6.6 million Brits to use credit cards for essentials like groceries. Reflecting ...

Read More

How Your Debt-to-Income Ratio Could Add £60,000 to Your Mortgage

Making a £60k credit card mistake? Lenders check your debt-to-income (DTI) ratio. Updraft explains how small debts affect your mortgage affordability.

Read More

This 64p Energy Bill Hack Could Save You £870 This Winter

This 64p energy bill hack could save you £870 this winter as the Oct 2025 price cap rises. Updraft explains how to swap and save.

Read More

Spooked by Spending? 5 Tricks to Tame Halloween Costs

Feeling spooked by high Halloween costs? Learn how to avoid overspending with 5 practical Halloween spending tips on costumes, decor, and parties from Updraft.

Read More

Consolidating Loans with Bad Credit

Find out how to consolidate loans with bad credit and improve approval chances with safer strategies.

Read More

Updraft Named One of the UK’s Top Fintech Companies for 2025

Updraft is honoured to be named one of the UK's Top Fintech Companies 2025 by CNBC & Statista for alternative financing. Learn more.

Read More

Travel FOMO from Instagram & TikTok Fuels UK Credit Debt Spike

Is travel FOMO causing you to overspend? New data links social media to a 21% rise in UK credit card debt. Understand the psychology.

Read More

TikTok scam preys on Britain’s 600,000-strong driving test backlog with £400 fee

A £400 TikTok scam targets the 600k driving test backlog. Fraudsters are luring learners with fake licences. Learn the risks and stay safe.

Read More

Latest BNPL instalment options could increase debt-related stress by 17%

BNPL instalments could increase debt stress by 17%. Learn what it means.

Read More

Protect Your Money Abroad: The 5-Minute Credit Card Tip

Adjust one setting before holidaying abroad to protect your money and avoid extra costs.

Read More

BoE Rate Cut: Why Your 36% Credit Card APR Won’t Drop

Bank of England cuts rates, but 36 million still face 36% APR. Explore why costs remain high.

Read More

We’re helping Brits take control of their credit card debt this summer

Summer spending pushes Brits £1,641 deeper into debt. Updraft's new Financial Lifeguard offers tips to help you budget better and cut interest costs.

Read More

The TikTok trend that could haunt your credit for at least six years

A TikTok credit trend could damage your score for six years. Find out what to avoid.

Read More

1 in 11 Brits Missed HMRC Deadline: Avoid Costly Penalties

1 in 11 Brits missed HMRC’s tax deadline. Learn how fines can reach £1,600 and how to avoid them.

Read More

Rising childcare costs push 1 in 6 parents to credit cards

Rising childcare costs push 1 in 6 UK parents to rely on credit cards.

Read More

Piggy Banks Are Back: Gen Z’s New Smash Jar Trend

Piggy banks are back, but Gen Z calls them smash jars. Explore how saving habits are changing.

Read More

How to Pay off Fast Loans

Learn how to pay off loans fast with repayment tips, consolidation, and smarter budgeting strategies.

Read More

A Guide to Credit Union Loans in the UK

Understand how credit union loans work, their benefits vs banks, and who can apply in the UK.

Read More

A Clear Guide to Borrowing Money in the UK

Learn safe ways of borrowing money in the UK. Compare loan options, risks, and tips to borrow responsibly.

Read More

How Many Credit Cards Can I Get?

Find out how many credit cards you should have, risks of multiple cards, and smarter alternatives.

Read More